child tax credit november 2021 date

3600 for children ages 5 and under at the end of 2021. 2021 Advance Child Tax Credit Payments start July 15 2021 Eligible families can receive advance payments of up to 300 per month for each child under age 6 and up to 250 per month for each child age 6 and above.

Updates On 38th Gst Council Meeting Gstr 9 Financial Information Council Meeting

CBS Baltimore -- The Internal Revenue Service IRS sent out the fifth round advance Child Tax Credit payments on November 15.

. November 25 2022 Havent received your payment. THE DEADLINE to opt-out of the child tax credit for November is approaching and those who dont want to receive the next child tax credit have until November 1 2021 at 1159pm to decline it. From July to December of 2021 eligible families received an advance child tax credit up to 300 per child under six years old and 250 for children between the ages of six to 17.

75000 or less for singles. 15 opt out by Oct. It is key to the Bidens administrations effort to.

Payments begin July 15 and will be sent monthly through December 15 without any further action required. The IRS has confirmed that theyll. To be eligible for the maximum credit taxpayers had to have an AGI of.

Ad The 2021 advance was 50 of your child tax credit with the rest on the next years return. The American Rescue Plan expanded the Child Tax Credit for 2021 to get more help to more families. Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

3000 for children ages 6 through 17 at the end of 2021. Child tax credit payment for Nov. For tax year 2021 the Child Tax Credit increased from 2000 per qualifying child to.

See what makes us different. The credit increased from 2000 per. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim.

Complete IRS Tax Forms Online or Print Government Tax Documents. 31 2021 so a 5-year-old turning 6 in 2021 will qualify for a maximum of 250 per month. 15 opt out by Aug.

Simple or complex always free. November 15 2021 242 PM CBS Los Angeles. The enhanced child tax credit which was created as part of the 19 trillion coronavirus relief package in March is in effect only for 2021.

29 What happens with the child tax credit payments after December. All payment dates. MyBenefits CRA mobile application.

File a federal return to claim your child tax credit. 15 opt out by Nov. The IRS bases your childs eligibility on their age on Dec.

Child tax credit payment for Nov. For both age groups the rest of the payment. When Will Your November Payment Come.

While the October payments of the Child Tax Program have been sent out many parents have said they did not receive their September check. Get your advance payments total and number of qualifying children in your online account. You can beneit from the credit even if you.

Those who miss the deadline can still claim the credit of up to 3600 per child if they file a 2021 tax return next year. The 2021 child tax credit payment dates along with the deadlines to opt out are as follows. November 12 2021 1126 AM CBS Chicago CBS Baltimore -- The fifth Child Tax Credit payment from the Internal Revenue Service IRS.

The 2021 child tax credit payment dates along with the deadlines to opt out are as follows. The Child Tax Credit is a fully refundable tax credit for families with qualifying children. The fifth monthly payment of the enhanced child tax credit is expected to hit your bank account on Nov.

Child and family benefits calculator. We dont make judgments or prescribe specific policies. The enhanced child tax credit which was created as part of the 19 trillion coronavirus relief package in March is in effect only for 2021.

Related services and information. Wait 5 working days from the payment date to contact us. The IRS bases your childs eligibility on their age on Dec.

31 2021 so a 5-year-old turning 6 in 2021 will qualify for a maximum of 250 per. IRSnews IRSnews November 7 2021 An income increase in 2021 to an amount above the 75000 150000 threshold could lower a households Child Tax Credit. 112500 or less for heads of household.

15 opt out by Nov. Benefit and credit payment dates reminders. The actual time the.

To reconcile advance payments on your 2021 return. Child Tax Credit. It is key to the Bidens administrations effort to.

13 opt out by Aug. Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics. The 500 nonrefundable Credit for Other Dependents amount has not changed.

The enhanced child tax. Enter your information on Schedule 8812 Form.

Child Tax Benefit Dates 2022 When It Is Deposited Genymoney Ca

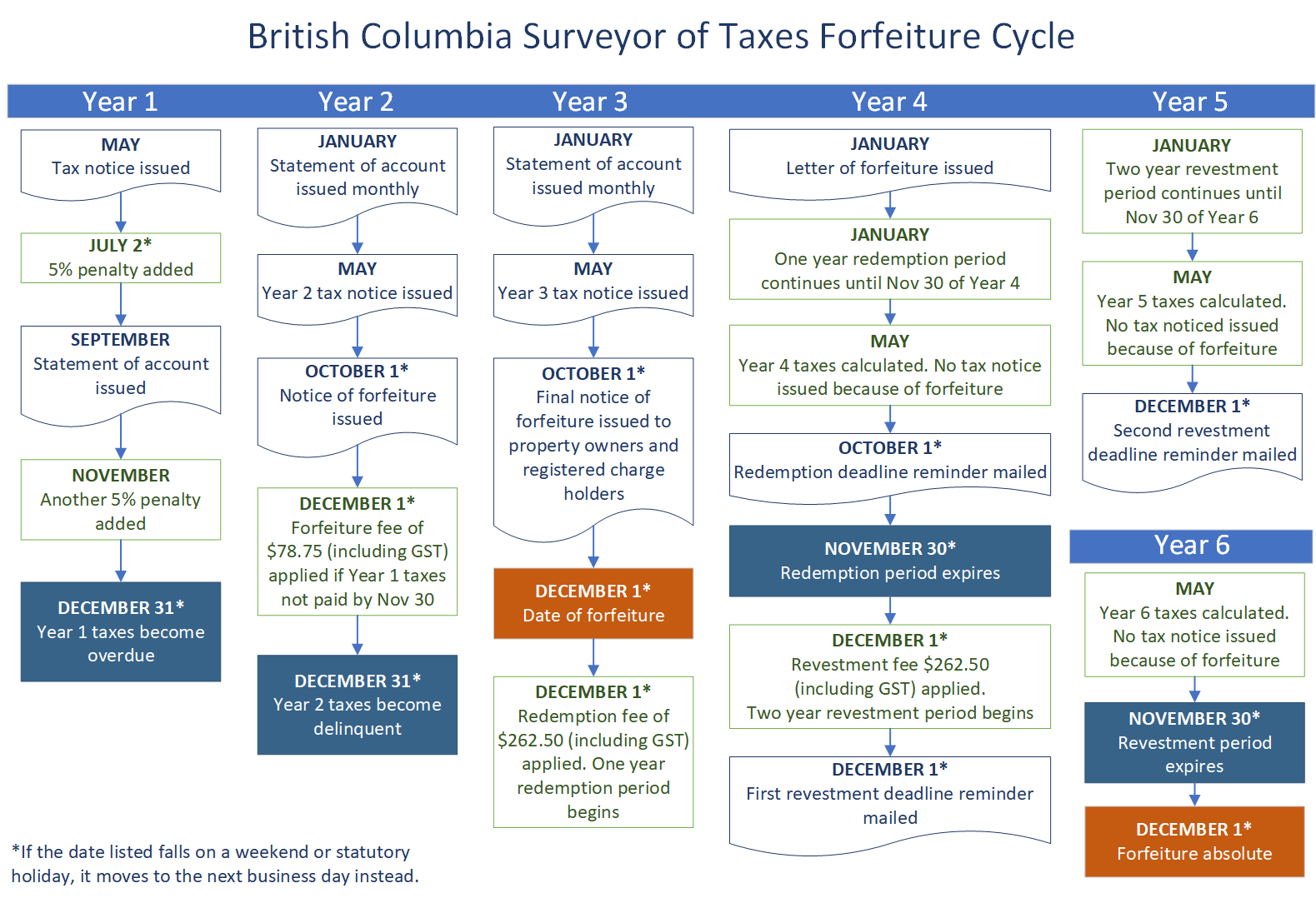

Overdue Rural Property Taxes Province Of British Columbia

The Oklahoma State Building And Construction Trades Council Is Hosting Its Fifth Annual Apprenticeship Open House On N Apprenticeship Building Trade Open House

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

Don T Overlook These Essential Small Business Tax Credits Small Business Tax Business Tax Tax Credits

Gst Payment Dates 2022 Gst Hst Credit Guide Filing Taxes

Canada Child Benefit Ccb Payment Dates 2022 Loans Canada

Tds Due Dates October 2020 Dating Due Date Income Tax Return

Canadian Tax News And Covid 19 Updates Archive

Canada Child Benefit Ccb Payment Dates Application 2022

Daily Banking Awareness 13 14 And 15 October 2020 Banking Awareness Financial

Canadian Tax News And Covid 19 Updates Archive

2022 Tax Deadlines And Extensions For Americans Abroad

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

Odsp Payment Dates 2022 When Do You Get Your Disability Benefits

Extended Gst Compliance Due Date Via Ct Notification 91 2020 Indirect Tax Compliance Due Date

Ontario Landlord And Tenant Law Rent Receipts What Is Required From A Landlord Being A Landlord Receipt Template Rent